What 90 Days of Irvine Closed Sales Reveal About Buyer Leverage in 2026

National headlines continue to label 2026 as a “buyer’s market.” In Irvine, that statement is only useful if you understand which price points and property types actually give buyers leverage.

This analysis is based on closed Irvine MLS sales from the last 90 days, using original list price versus final sale price and cumulative days on market. These are not projections or opinions. This is what buyers and sellers have already agreed to.

Irvine Is Not One Market

Irvine behaves as dozens of micro-markets. Condos do not behave like single-family homes. A $1.1M townhome does not behave like a $2.2M house. National averages hide this reality.

The current market is best described as a negotiated market, not a distressed one.

What the Last 90 Days of Irvine Sales Reveal

Across all price ranges, most Irvine homes are selling below their original list price, and cumulative days on market are meaningfully longer than many sellers expect. This creates leverage for buyers who understand timing, pricing discipline, and micro-market behavior.

Irvine Closed Sales – Median Sale-to-List Percentage by Price Band (Last 90 Days)

Source: Irvine MLS closed sales, last 90 days. Analysis by Debbie Sagorin, Coldwell Banker Realty.

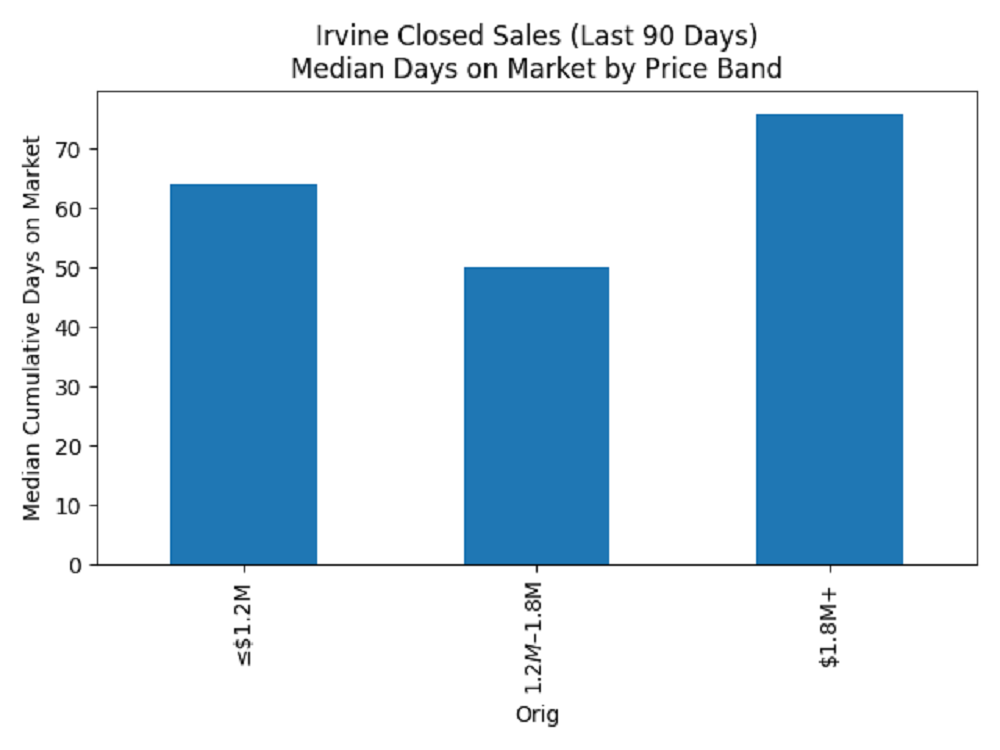

Buyer Leverage by Price Point

Homes Priced at $1.2M and Below

Even in Irvine’s most active segment, most homes sold below asking price and market time often extended well beyond the first few weekends. Condition, HOA costs, and presentation heavily influence outcomes at this level.

Homes Priced Between $1.2M and $1.8M

This remains Irvine’s most competitive price range, yet the majority of homes still closed below list. Homes that were priced correctly and well-prepared sold faster, while overpricing typically resulted in extended market time and later price reductions.

Homes Priced Above $1.8M

This is where buyer leverage is strongest. Discounts relative to list price are deeper, market time is longer, and a thinner buyer pool means pricing errors are costly.

Irvine Closed Sales – Median Cumulative Days on Market by Price Band (Last 90 Days)

Source: Irvine MLS closed sales, last 90 days. Analysis by Debbie Sagorin, Coldwell Banker Realty.

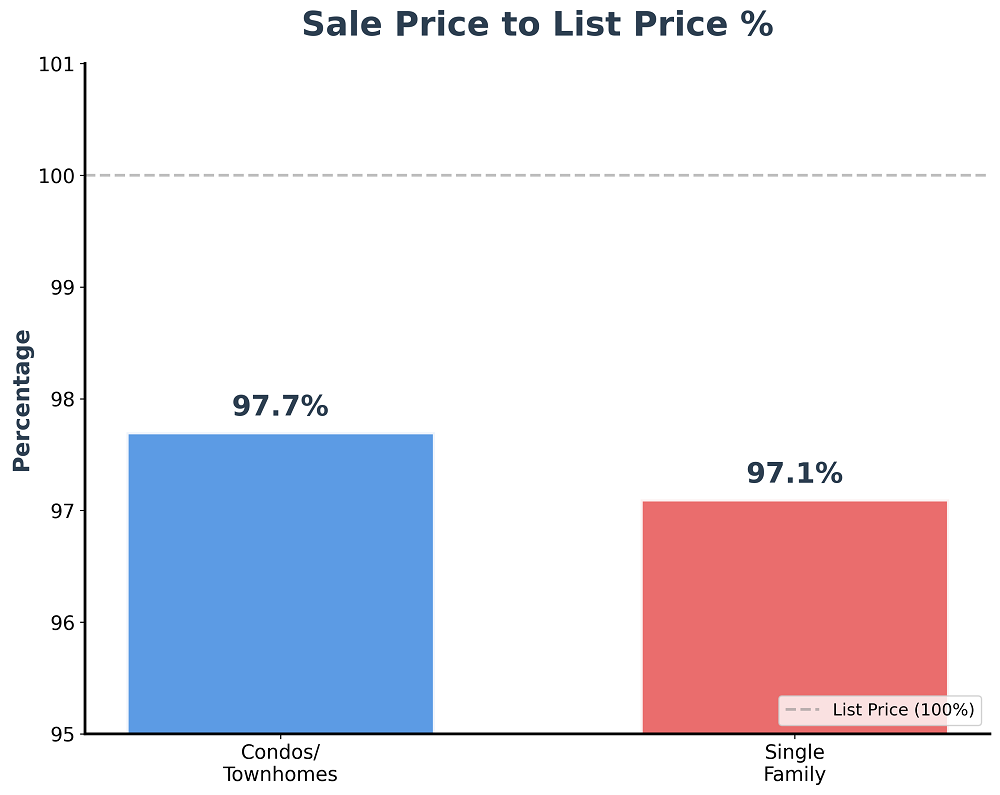

Why Property Type Matters in Irvine

One reason Irvine behaves differently than many national headlines is the mix of property types. Attached housing represents a large share of closed sales, and that influences negotiation patterns because HOA fees and monthly payment sensitivity play a bigger role for many buyers.

Irvine Closed Sales – Property Type Distribution (Last 90 Days)

Source: Irvine MLS closed sales, last 90 days. Analysis by Debbie Sagorin, Coldwell Banker Realty.

Condo and Townhome Performance

For this analysis, condos and townhomes are combined, reflecting how properties are commonly entered in the MLS. In the current market, attached homes often sell below list price, and buyers frequently have meaningful negotiation power in this segment.

Single-family homes still command attention when they are turnkey and priced accurately, but even those are not immune to negotiation when pricing overshoots what today’s buyers are willing to pay.

What This Means for Irvine Buyers in Early 2026

Buyers should stop waiting for rate headlines and start watching local signals:

- Cumulative days on market

- Price reductions

- Which homes failed to sell in their first 14 to 21 days

The advantage today is not speed alone. It is informed negotiation.

What This Means for Irvine Sellers

Sellers can still achieve strong results, but the margin for error is thinner:

- Pricing accuracy from day one matters more than ever

- Presentation directly affects negotiating power

- Homes that miss their initial market window often sell for less later

The market is now correcting expectations quickly.

The Bottom Line

Is Irvine a buyer’s market in 2026? Not everywhere. Not at every price. But buyers with the right strategy absolutely have leverage.

In Irvine, success depends on understanding micro-markets, understanding price bands, and reading buyer behavior, not national headlines.

Debbie Sagorin

Sagorin & Associates

Coldwell Banker Realty